🚗 Carlypso, Carvana, now Clutch: An Interview with Nicholas Hinrichsen

I interviewed Nicholas Hinrichsen, Co-Founder of Clutch, a company bringing transparency to auto loan refinancing (15 min read)

Homescreens is a weekly newsletter where I interview creators and founders in tech about what's on their phone. We reflect on their favorite apps, productivity hacks, and unique quirks. If you’re reading this but haven’t subscribed, get interviews like this in your inbox every Friday morning by subscribing here!

Nicholas “Nicky” Hinrichsen was born and raised in Germany and for a time played on the German National Golf Team. In an alternate reality, I’d be interviewing Nicholas Hinrichsen the pro golfer, not the entrepreneur. After studying computer science and finance, he came to the U.S. in 2011 to attend Stanford Business School, where he met his future co-founder, Chris Coleman.

It was at Stanford they founded Carlypso, an online marketplace that gave consumers access to thousands of vehicles typically sold in wholesale markets. After a successful run, they sold the business to a pre-IPO Carvana in 2017 and joined the ranks of their executive team.

Earlier this year, Nicky left Carvana to start Clutch, a digital platform that is all about saving you money through refinancing your auto loan.

What follows is our interview, edited for length and clarity.

I’d love to start off with a little bio about yourself, tell me about your entrepreneurial journey starting with Carlypso and now Clutch.

I moved to the U.S. in 2011 to go to business school, and that’s where I met Chris. Chris is a huge car enthusiast—his first car was a DeLorean, like the one from Back to the Future. So not surprisingly towards the end of business school, our classmates asked him for advice on how to sell a car because everyone was moving to San Francisco. So, we went from giving advice to selling our classmate’s cars, and by the end of business school, we probably sold 60 to 70 cars on Craigslist.

We’d go through the whole process of detailing cars, taking photos, listing them, waiting for people who never showed up, people who wanted to just kick the tires, test drives, accepting cash, and negotiating on behalf of the seller—all of the good things.

Then, our professors heard about it and wanted to learn more. We told them what we were doing—we thought it was just a summer project—and they’re like “no, no, you should make this a business! And if you make this a business, here’s $50,000 to get started”. So, it was basically Andy Rachleff, our professor, who encouraged us to do it, who is obviously an incredible person.

We raised $1.2 million based on this idea of building a peer-to-peer marketplace, we went through Y Combinator, the startup accelerator in the Bay Area, then pivoted a little bit: we removed the seller out of the equation because private sellers always think their cars are worth more, I’m sure you’ve come across that a few times [laughs]. Instead, we worked with leasing companies, rental companies, and found ways to make the inventory that was selling at auction available to consumers.

And so that way we were a licensed dealership, but we basically never had inventory until somebody said, “this is the exact car I want to buy”. We called it virtual consignment, virtual wholesale, you name it. That worked really well, we raised a total of $10 million to scale the business to north of $35 million in run-rate.

Then, we asked ourselves, “should we raise more money and double-down, or is there a smarter, more clever step to take from here?” Because at the time, what we thought was going to be a tech company required a lot of physical infrastructure and operations—vehicles need to be reconditioned, need to be moved, need to be transported, right? The other problem we had was we couldn’t lend money to borrowers with credit scores below 700, so we could really only finance prime credit. We were a young “dealership” and that made it really difficult to convince banks and lenders to work with us.

And then, one of our classmates happened to be working in partnerships at Carvana, so we reached out to her and asked her, “hey wanna compare notes?” So that went from an email, to a quick call, to us visiting Carvana and getting to know the executives: the Chief Product Officer and Ernie [Garcia], and becoming friends with them. And then agreeing that it’s probably smarter for us all if Carlypso just joined Carvana—so we sold the business and brought the whole team with us. That was in 2017, and from then on we were, I hope, contributing largely to what Carvana became over the last three years.

Well, it’s been a Hell of a three year run for them—so I’d say so.

Right. At Carvana, Chris was running product, the front-end experience, everything pre-purchase. So the search page, vehicle detail pages—these pages are fed really heavily by data, and the service data pipeline, at least version 1.0, now they’re probably at 100.0, was what we had built at Carlypso.

If you go to the vehicle detail page, you see the vehicle descriptions, you see the window stickers available for some of them—we actually built that to make our salespeople more effective every time they talked to a customer. We wanted our salespeople to be very quick in searching for cars by vehicle details in the auction inventory. So if somebody called in saying “Hey I’m Jason, I want to look for this 3 Series BMW in white, with a backup camera” and you wanted to search for that really quickly, instead of just going through Manheim and checking boxes and stuff, these tools became really powerful to support our salespeople.

That’s funny you say that because that’s my car, and I actually bought it on Carvana.

That’s very random, I didn’t know [laughs]. Okay, I need a beer, that’s funny. Well, I joined Carvana to make the trade-ins a better experience. A trade-in is a way to get another buyer because he uses his trade-in as a down payment. But, the experience wasn’t as great as buying a car from Carvana, so there was some low hanging fruit that we took care of. I was talking to customers all the time trying to understand what they liked about the value proposition; you would think it’s all about price, but especially today, convenience makes such a big difference given that people don’t want to interact in person. At the time the website said “oh great, you want to sell your car, we’ll call you,” and then we never called. It wasn’t what Carvana was focused on, and they knew they wanted to build that business but nobody had taken the initiative [yet], which makes sense because there were so many other things to build and support.

We went from having a team of three to four people to scaling this business to what then, later on, became “Sell to Carvana”, and I ran it all the way up until June. I think in July Ernie said that we were buying more cars than we were selling which was a cool milestone. Then Chris and I decided to leave after three years. The entrepreneurial bug started itching again, and we wanted to dive into the refinance space.

Which leads us to Clutch.

People who make their [auto loan] payments improve their credit, by quite a lot at times. And, if they have better credit they would qualify for a lower rate, but people just don’t refinance cars, they don’t know it’s a thing. The portion of people refinancing their auto loans is like 5% of all funded auto loans per year. Compared to mortgages, more than 50% of mortgages in 2020 will be refinanced. So, a massive difference and it’s not actually completely different.

So what we want to do is use this refi as the wedge, starting to help people lower their car expenses. Then, once we have someone refinancing we try to engage the customer and enhance—so you have gap insurance, you have positive equity so you don’t need that: cancel and get the refund. Your warranty, maybe you’re over-protected—you’re not driving as much as you thought—but you’re paying for this, so let’s get a refund and get you a cheaper one. A lot of these things are completely not obvious. Another thing we found is people selling their cars completely forgot that they have gap insurance or a service plan, so there is so much money lying on the table. The warranty companies and underwriters devour it because the customers forget to tell the dealership “hey give me a refund because I just sold my car”.

I’m sure you know Dealertrack or RouteOne, these are services that dealerships use to send out your loans and figure out who gets approved. That’s a screen the customer never gets to see, only the dealership sees it. So if you imagine if this is a table, the dealership will sort the column by the highest referral fee, whereas the customer would sort by the lowest rate, right? So the reason the dealership needs to do that is because his margin is purely limited by the number of cars he can sell, so the only thing you can do is try to make up as much margin as possible. In our case, we don’t have that physical constraint, we can refinance endless people. In order to create a flywheel effect, you don’t want to be the one that makes the most money, you want to be known as the lowest cost refinancing company, so then you start the flywheel when word of mouth starts. We’re basically taking Dealertrack and reverse it so the customer gets to pick the lowest rate.

That’s a great comparison and makes perfect sense, very cool and I love the concept—bringing transparency to the opaque auto loan industry.

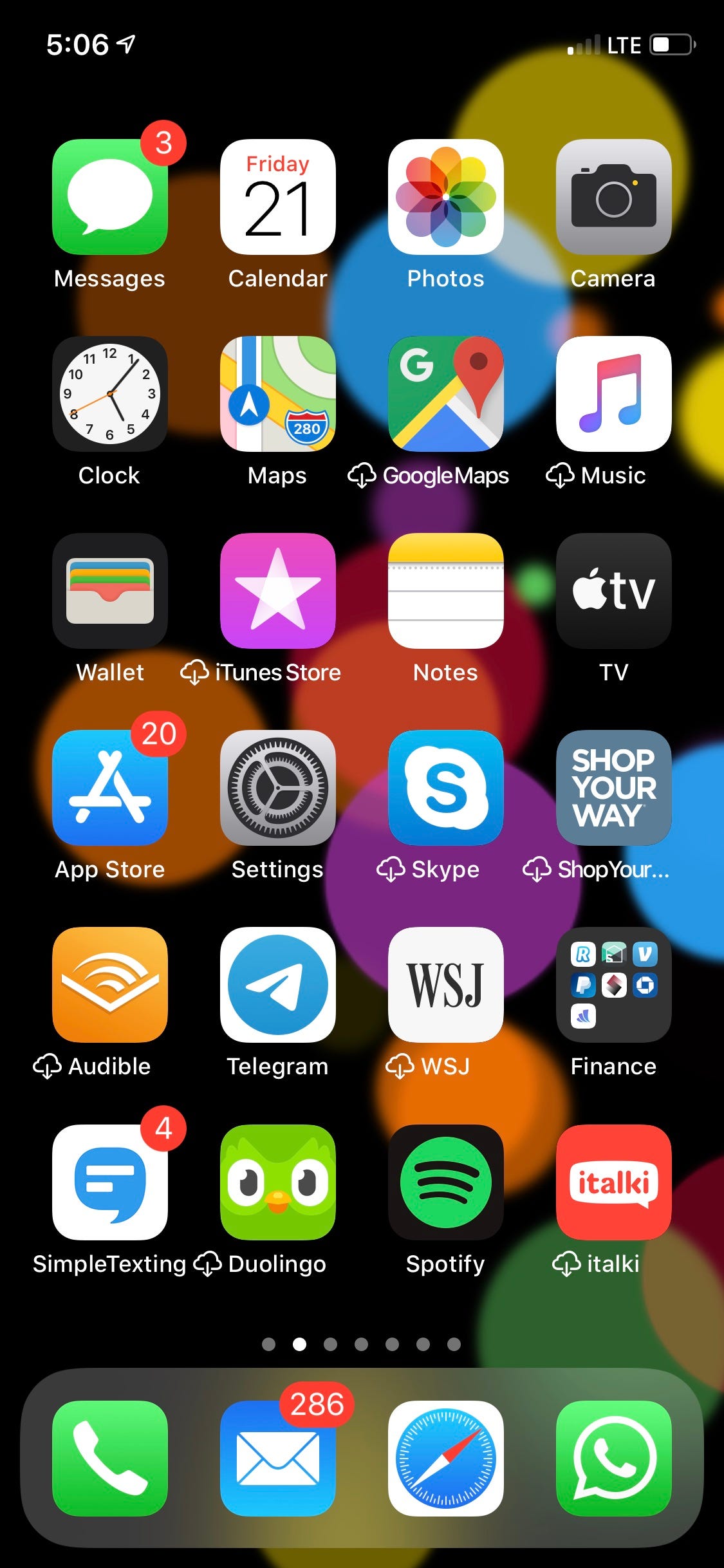

Let’s dive into your phone. The first thing I noticed was you have both Duolingo and italki, both are language learning apps. Are you using both?

You’re very attentive, I think we should start with the little cloud symbol right next to a few apps [which means] you haven’t used them in awhile. I haven’t used any of these apps like Google Maps, iTunes Music, Skype, Audible, Duolingo, italki in awhile. So, my phone is really weird because I use it to text, email, make phone calls, check the calendar, and that’s about it.

You are very utilitarian, using your phone as a phone. You have multiple messaging apps: Telegram, and that’s WhatsApp at the bottom right?

Yeah, this is somewhat linked together. So Telegram is interesting because we started with a good group of friends from business school where we wanted to chat, but we also didn’t want everyone to know what we were chatting about [laughs]. And so with Telegram a) you can password protect it and b) it’s all encrypted. That’s why I have Telegram. WhatsApp I use to speak to my family in Germany, and to all my friends in Latin America. And that explains why I have the Duolingo and italki apps because I speak German, Spanish, and English, and I love Brazil, but I know like seven words in Portuguese. If we did a little bit of small talk you would be like—wow, you speak Portuguese—but only the same words.

I thought at the beginning of the pandemic this is the perfect opportunity to learn better Portuguese, and with italki, you actually have a tutor—somebody in Brazil who takes the time to teach you. It’s really cool. I think this is how you learn it because you’re having real conversations with a real person, while in Duolingo you practice sentences, you practice grammar. Both are good apps, but take very different approaches to learning languages.

The fun thing is, when you log in you talk to someone in like rural Brazil. It gives people in rural Brazil the opportunity to earn in [U.S.] dollars, which is exciting, and for me, a really easy opportunity to have a conversation with a native speaker.

That’s novel, I haven’t seen anything like that. It’s almost like a language learning gig economy. Are you always paired with the same tutor? Or is it like Uber where you log in and hit a button to find the next available tutor?

You use the same one, you’re on a schedule. Like every day at 6pm for half an hour, you learn Portuguese.

Another messaging app I wanted to talk to you about is SimpleTexting. Is this a B2C messaging app?

Something like that. When we started selling cars peer-to-peer, the best place to sell cars was Craigslist. So in order to list cars on Craigslist, you needed an account, and in the beginning, you could list as many cars as you wanted. But then Craigslist became really intelligent quickly and wouldn’t allow a private person to list multiple cars. So in order to list multiple cars, you would have to create multiple email accounts, and you have to have an individual account per car you were selling, and you needed individual phone numbers. Otherwise, Craigslist realized it’s the same person. There was no such tool to support that, that would allow you to manage multiple phone numbers.

But, Twilio was out. So I built this tool in PHP, it was horrible, but it did exactly that—it allowed you to create multiple phone numbers really easily, and then you could have multiple threads. In our new business, we have these submissions, and at the bottom of the funnel, it’s not fully automated yet. In the long run, we want to have this marketplace where the customer just chooses everything and it doesn’t need any human intervention. In the current version, at the very end, it will tell you—Hey we will look up a loan for you and come back to you. It’s clunky, but it’s a prototype. We send automated text messages, and the tool we use is SimpleTexting.

I see the Audible app has the cloud symbol next to it, so you haven’t used it in a bit, but what was the last book you listened to that you would recommend?

There was one called Competing Against Luck from Clay Christensen. It’s basically a book about succession of the innovator’s dilemma and how you come up with startup ideas. Like how does innovation happen? He introduces this concept of “jobs to be done”. He starts out with a banana and a milkshake. What do you eat a banana for and what do you eat a milkshake for? Why are these competing products? He explains it’s because they give you a lot of energy early in the morning when you're on your way to work. The problem with the banana is you eat it quickly. By the time you reach the office you’re already on the downhill, whereas with the milkshake it takes a long time to drink because it’s so thick, so it does a better job for that use case. It’s quite fascinating how he compares different things.

Another that I think is worth listening to as a founder like once every two years is Blitzscaling. You have these different stages your company can be in, and if you go through it in real-time, it feels slow, you’re moving slowly. But the view here is—oh, yeah, I’m in a very different phase than I was a year ago.

That’s a great one. You have Spotify on your screen, are you using it mostly for music, podcasts, both?

Mainly music, I have a playlist where I’m adding more and more songs, and it’s gotten pretty long now—it’s the main form of media consumption for me. There’s like 150 songs or so. It starts with some house music then quickly goes into reggaeton, then back to house, then some classic American songs, back to house and reggaeton, and at the very end Brazilian music. I run every morning, that’s when I listen. Now that everybody’s working remotely I find myself on calls a lot, but if I weren’t on calls and I’m thinking through things I listen to music. In the evenings when we have dinner, we play music.

Are there any quirks that you have with your phone?

Oh yeah, I watch Netflix movies and lots of YouTube on my phone!

Wow, YouTube—okay makes sense, but Netflix? Where and when are you watching?

When I go to bed, I watch—this is clearly a quirk—I love America’s Got Talent. I always watch the really successful people that are big surprises, it’s just fun and makes me happy to see them succeed. The newest thing I watch a lot is magic tricks by Shin Lim, just look up “magic” and “America’s Got Talent” and it’s insane. Watch this guy, you can’t stop, you’ll be like—how is this possible?

That’s awesome, I’ll definitely have to check him out. Nicky, I appreciate your time. This was a ton of fun, loved chatting with you and we’ll have to stay in contact.

Same here, stay healthy and sane and safe!

Endnote

Thanks for reading my interview with Nicholas. His new venture Clutch is all about saving Americans money through refinancing auto loans. With a few simple clicks, you can save thousands and it's so quick, you'll be done with the process before Nicholas gets to finish watching yet another episode of America’s Got Talent on his phone.

📱App and Media Recap

✉️ Telegram - Pure instant messaging — simple, fast, secure, and synced across all your devices.

✉️ WhatsApp Messenger - WhatsApp Messenger is a FREE messaging app available for iPhone and other smartphones.

✉️ SimpleTexting - SimpleTexting is the leading platform for sending mass text message campaigns and connecting 1-on-1 with your customers.

🧠 Duolingo - Learn a new language with the world’s most-downloaded education app! Duolingo is the fun, free app for learning 35+ languages through quick, bite-sized lessons.

🧠 italki - Learn languages with native speakers in 1-on-1 online lessons or make money teaching languages online!

📚 Audiobooks: Competing Against Luck: The Story of Innovation and Customer Choice, Blitzscaling

🤹♂️ Videos: Shin Lim | WINNER | All Performances | America's Got Talent 2018